Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Free English Templates: Cover Letters, Resumes, Contracts & More

Free English Templates: Cover Letters, Resumes, Contracts & More

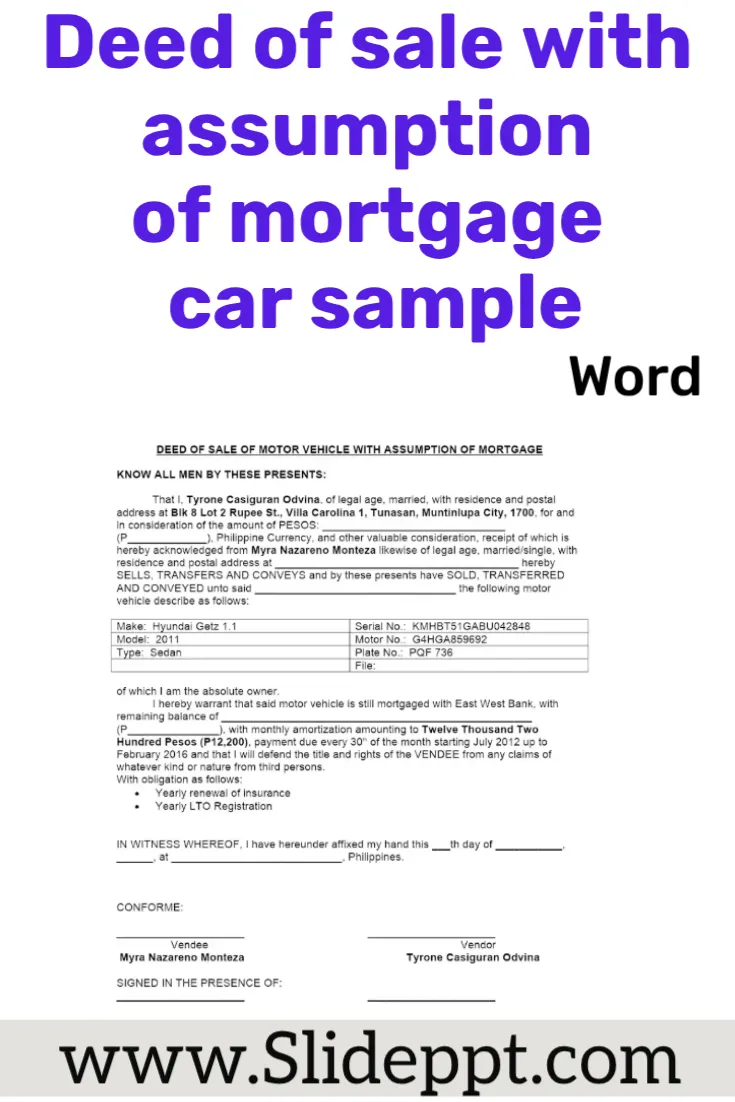

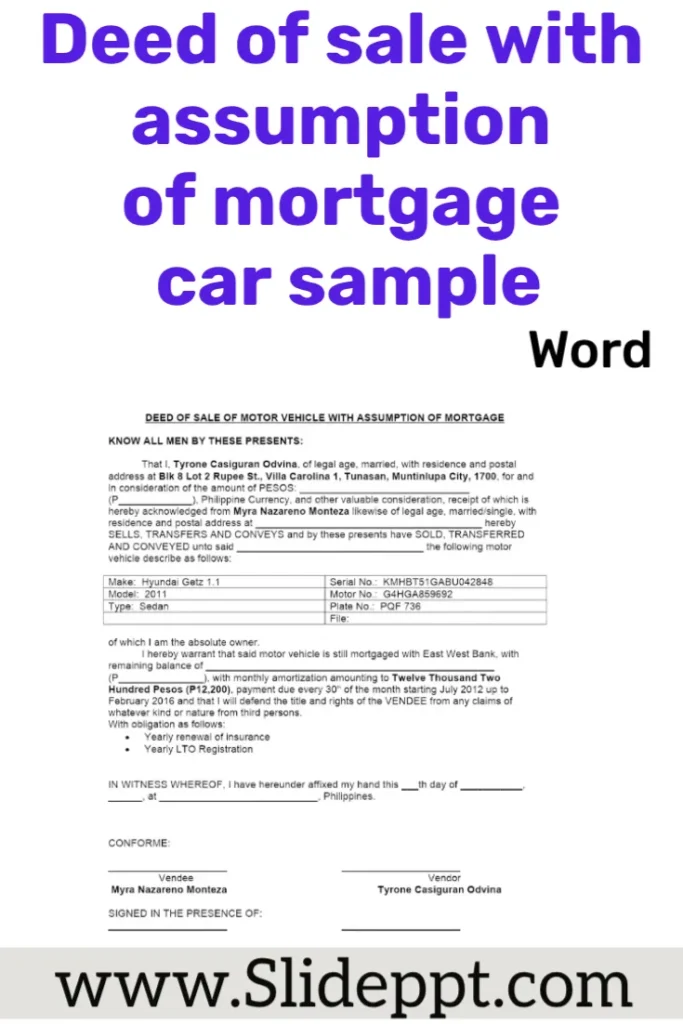

All you need: deed of sale with assumption of mortgage car sample, steps, FAQs, and a Word template you can download and customize.

What if you could transfer a car and its existing loan in one clean, well-structured document? That’s exactly what a deed of sale with assumption of mortgage car sample helps you do. Whether you’re the seller getting out of a chattel loan or the buyer taking over payments, a clear, lawful paper trail protects both sides. In this guide, you’ll get a plain-English overview, a checklist of clauses, and a downloadable deed of sale with assumption of mortgage car sample in Word format you can adapt.

We’ll cover the difference between a deed of sale (transfer of ownership) and an assumption of mortgage (taking over the loan), when lender consent is required, what to include for vehicle identification (engine/chassis/plate), and how to register the transfer with your local authority (DMV/LTO). You’ll also find tips for avoiding common pitfalls—like skipping notarization or missing lien releases. If you’re in the Philippines, we include practical notes for LTO transfer and chattel-mortgage annotation.

A bill of sale/deed of sale is the instrument that transfers ownership of personal property—such as a car—from seller to buyer. In common-law systems, bills of sale evidence the change of title in goods (movables). Wikipédia+1

An assumption of mortgage is when the buyer agrees to take over the existing loan’s terms and balance. For real-estate loans, assumptions are sometimes restricted by due-on-sale clauses; where allowed, the lender often must consent and qualify the new payer. The concept of assumption is well-documented in finance and contract law and—by analogy—helps explain how a buyer may step into the borrower’s obligations. Wikipédia+1

Cars are chattels (movable property). Many car loans are structured as chattel mortgages (a security interest over the vehicle). When selling a financed car, you must deal with that security interest: either pay off and obtain a release, or document a proper assumption supported by lender consent if applicable. Wikipédia+1

Voice search–friendly: “How do I sell a car that still has a loan?”

Answer: Arrange a payoff and lien release, or use a deed of sale with assumption of mortgage car sample with lender consent and clear lender instructions.

Deed of sale with assumption of mortgage car sample + free Word template, steps, and FAQs for clean title transfer.

👀👉👉[🔗 Download]

Note: Always verify local requirements and lender rules before signing.

Must-have details (H3)

Full legal names, addresses, and IDs of Seller and Buyer

Date and place of execution; notary block

Vehicle identifiers: make/model/year, color, plate number, engine no., chassis no., MV/File number (if applicable)

Why it matters: Vehicle ID and capacity to contract are foundational to title transfer of goods; documentation supports the later update of the vehicle title/registration at the competent agency. Wikipédia

Key clauses (H3)

Price in words and figures; payment mode (cash/bank transfer)

Delivery: date/time, keys, OR/CR (or equivalent), manuals, spare keys

Risk & insurance handover (who insures from when)

Why it matters: A bill of sale records the exchange of value and transfer of possession/title—critical evidence if disputes arise. Wikipédia

What to write (H3)

Loan details: lender/bank, account number, outstanding balance reference

Buyer’s express assumption of mortgage obligations (principal, interest, fees)

Condition precedent: effective upon lender’s written consent/novation (if required)

Allocation of arrears and penalties (before vs. after signing)

Cooperation clause to secure consent and update annotations/records

Why it matters: Many lenders require consent and a formal release/novation process for an assumption to bind them. Without consent, the seller may remain liable even after a private sale. Wikipédia

Include (H3)

Disclosure of any liens/encumbrances

The seller’s warranty of title (no undisclosed claims)

Chattel-mortgage release (if loan is paid off) or lender’s written assumption approval

Post-closing obligations (e.g., submit lien-release to registry)

Why it matters: A chattel mortgage is a perfected security interest over the vehicle. Releases and correct filings prevent enforcement against the buyer. Wikipédia

Confirm lender policy

Ask the bank if they allow a car-loan assumption. If yes, request the process/requirements and draft your deed of sale with assumption of mortgage car sample accordingly. Investopedia

Complete the parties/vehicle block

Copy identifiers from the registration certificate and verify engine/chassis numbers.

Fill price & payment terms

State full price; specify down payment vs. balance, and responsibility for taxes/fees.

Add the assumption language

Insert lender’s name, account number, and a clause making the assumption effective upon lender’s written consent.

Notarize

Execute before a notary. Keep at least three originals (buyer/seller/authority).

Register the transfer

Submit the deed and supporting documents to the DMV/LTO as required to update the title/registration and (where relevant) annotate/cancel the mortgage. Wikipédia

Voice search–friendly: “Do I need notarization for a car deed of sale?”

In many jurisdictions, notarization is expected or required to update registration and defend against fraud; always follow your local authority’s rules.

If you’re completing a Deed of Sale of motor vehicle with Assumption of Mortgage Sample Philippines, practice commonly involves notarization and filing with the Land Transportation Office (LTO), along with the vehicle’s OR/CR and other supporting papers (e.g., PNP-HPG clearance, insurance, emission test). Administrative guidance and practitioner explainers emphasize timely reporting/transfer and, where applicable, the release or annotation of a chattel mortgage. OneLot+5LTO+5RESPICIO & CO.+5

Tip: Some advisories discuss reporting within set timeframes after notarization/signing and maintaining notarized copies for both parties—good habits that help avoid penalties and disputes. Always confirm current LTO rules and branch practices. LTO+1

| Section | What to include | Drafting tips |

|---|---|---|

| Parties & IDs | Full names, addresses, ID types/numbers | Match IDs to signatures; add tax IDs if requested |

| Vehicle | Make/model/year, color, plate, engine, chassis, MV/File no. | Copy exactly from registration |

| Consideration | Price (words & figures); payment method/schedule | Say who pays taxes/fees/insurance |

| Assumption | Lender name & account; buyer’s assumption; consent | Make assumption conditional on lender consent |

| Liens/Title | Disclose encumbrances; warranty of title | Attach lien release or consent when available |

| Delivery | Keys, OR/CR (or equivalent), manuals, spares | State the exact handover date/time |

| Registration | Party responsible for filing; deadline | Reference DMV/LTO process broadly |

| Signatures | Seller/Buyer; Lender consent block | Notary acknowledgement text |

Skipping notarization: weakens enforceability and may block registration updates.

Ignoring the lender: many institutions must approve any assumption of mortgage.

Vague vehicle data: mis-typed engine/chassis numbers stall title transfer.

No lien release/annotation: a chattel mortgage can survive the private sale if not properly released or re-annotated. Wikipédia

How do I write a deed of sale with assumption of mortgage car sample?

Use our deed of sale with assumption of mortgage car sample (download below). Include parties, vehicle identifiers, price, the buyer’s assumption of the existing loan, a lender-consent clause, warranties, and notarization.

Can I assume a car loan without lender consent?

Often no—many lenders require consent and buyer qualification before recognizing an assumption. Otherwise, the seller may remain liable. Wikipédia

What documents do I need to transfer vehicle title?

Generally: notarized deed/bill of sale, proof of ID, existing registration/title documents, and lien release or lender consent if the car is financed. Agency rules vary by jurisdiction. Wikipédia

What is a chattel mortgage?

A security interest over movable property (like cars) that secures repayment of a loan. It must be properly released/annotated at transfer. Wikipédia

Download the Word template (.docx)

Use this as your Deed of Sale with Assumption of Mortgage Sample. Replace bracketed text, add your local law/venue, and confirm your lender/DMV/LTO requirements before signing.

Important: This template is educational, not legal advice. Laws and agency rules change. Consult a qualified professional in your jurisdiction for compliance.

Bill of sale overview and purpose. Wikipédia

Mortgage assumption—consent and due-on-sale context (conceptual background). Wikipédia+1

Vehicle title/registration transfer concepts. Wikipédia

Chattel mortgage (security over movables). Wikipédia

(PH) LTO administrative guidance and practitioner explainers on deed of sale, timing, and documentary sets. LTO+2RESPICIO & CO.+2

A clean, comprehensive deed of sale with assumption of mortgage car sample protects buyers, sellers, and lenders. Start with a precise vehicle description and a clear purchase price. Make the assumption of mortgage explicit and—where required—conditional on lender consent. Notarize the instrument, keep multiple originals, and promptly file the transfer with your local authority (DMV/LTO). Mind lien releases or proper annotations if a chattel mortgage exists, and update insurance as soon as possession changes hands.

Ready to finalize your paperwork? Download the Word template, customize it with your data, and follow the checklist above. If your case involves special circumstances (company seller, cross-border buyer, unusual payment structures), ask a licensed professional to review before you sign. Share this guide with anyone selling a financed vehicle—good documentation saves time, money, and stress.

Share via: